DTE stands for Days To Expiration. It tells you how many days are left until an options contract expires.

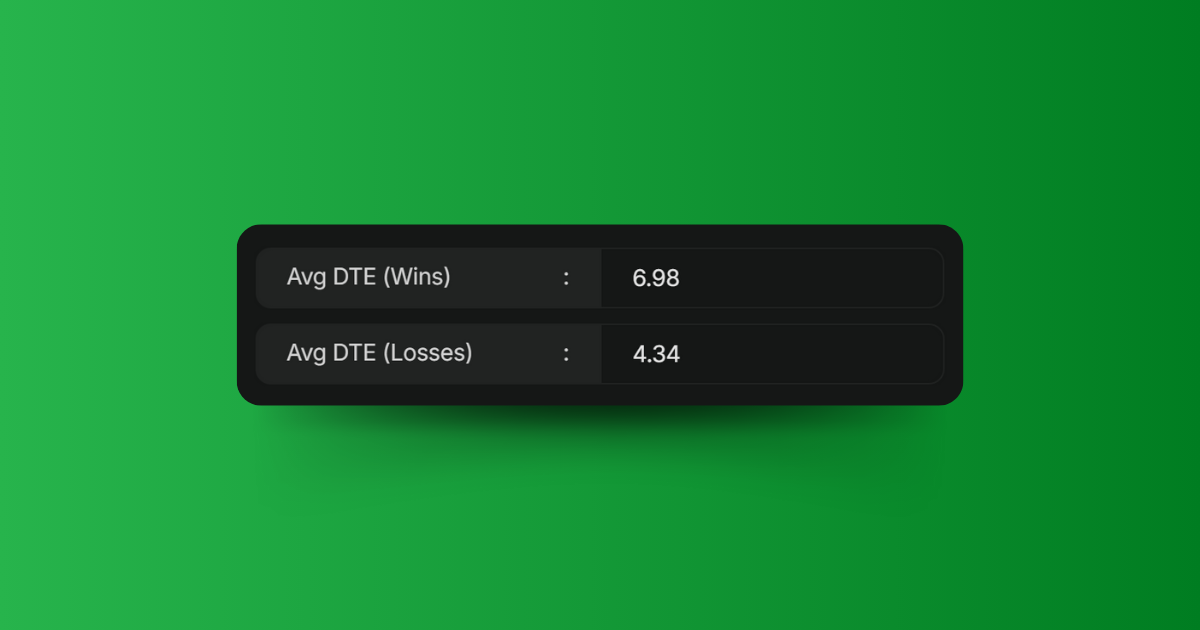

What is Average DTE (Wins)?

Average DTE (Wins) shows you, on average, how many days were left until expiration on your winning options trades. It helps you see how long you typically hold your winning options.

Average DTE (Wins) = Total DTE of Winning Trades / Total Number of Options Trades

Average DTE (Wins):

- Total DTE of winning trades: 300 days

- Number of winning trades: 10

- Calculation: Average DTE (Wins) = 300 days / 10 = 30 days

- Interpretation: Winning trades have an average DTE of 30 days.

A trader uses Average DTE (Wins) to see if they’re typically making money with short-term or long-term options. If the average is low, they’re making money with shorter-term options. If it’s high, they’re making money with longer-term options. This can help them refine their strategy and understand how time affects their profitable trades.

What is Average DTE (Losses)?

Average DTE (Losses) shows you, on average, how many days were left until expiration on your losing options trades. It helps you see how long you typically held your losing options.

Average DTE (Losses) = Total DTE of Losing Trades / Total Number of Options Trades

Average DTE (Losses):

- Total DTE of losing trades: 150 days

- Number of losing trades: 15

- Calculation: Average DTE (Losses) = 150 days / 15 = 10 days

- Interpretation: Losing trades have a much lower average DTE of 10 days.

A trader uses Average DTE (Losses) to see if time decay or holding too long is affecting their losing trades. If the average is low, they might be closing losers quickly. If it’s high, they might be holding onto losing options for too long, letting time decay eat away at their value. This can help them improve their risk management and avoid unnecessary losses.

| How It Can Be Used | Limitations |

|---|---|

| Identifying optimal expiration periods for profits | May be influenced by outlier trades |

| Adjusting strategies to focus on profitable DTEs | Doesn’t consider other factors affecting outcomes |

| Understanding time decay impact on wins and losses | May not account for changing market conditions |