Sometimes, you may need to adjust the details of a trade after the fact, whether it’s updating the quantity, correcting a price, or tweaking the strike price for options. In TraderLog, you have full control over your trading history, making it easy to update any trade in just a few steps.

Step-by-Step: How to Edit a Trade

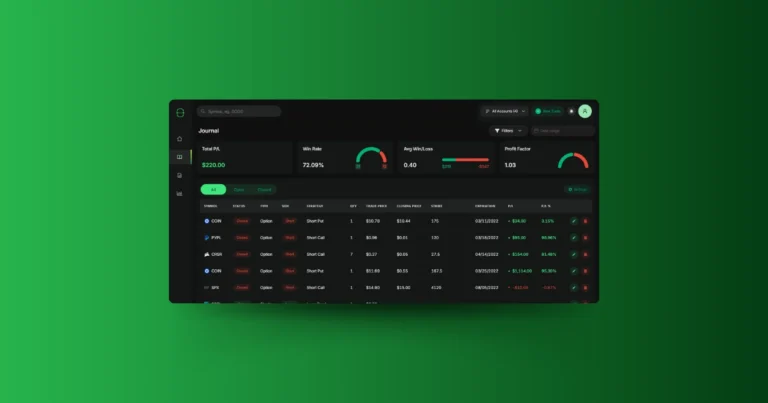

To begin editing a trade, navigate to the Journal page in TraderLog. The journal displays all your trades in a table format, listing details like symbol, trade price, and profit/loss. Each trade row includes an Edit button that allows you to modify trade information.

- Locate the Trade You Want to Edit

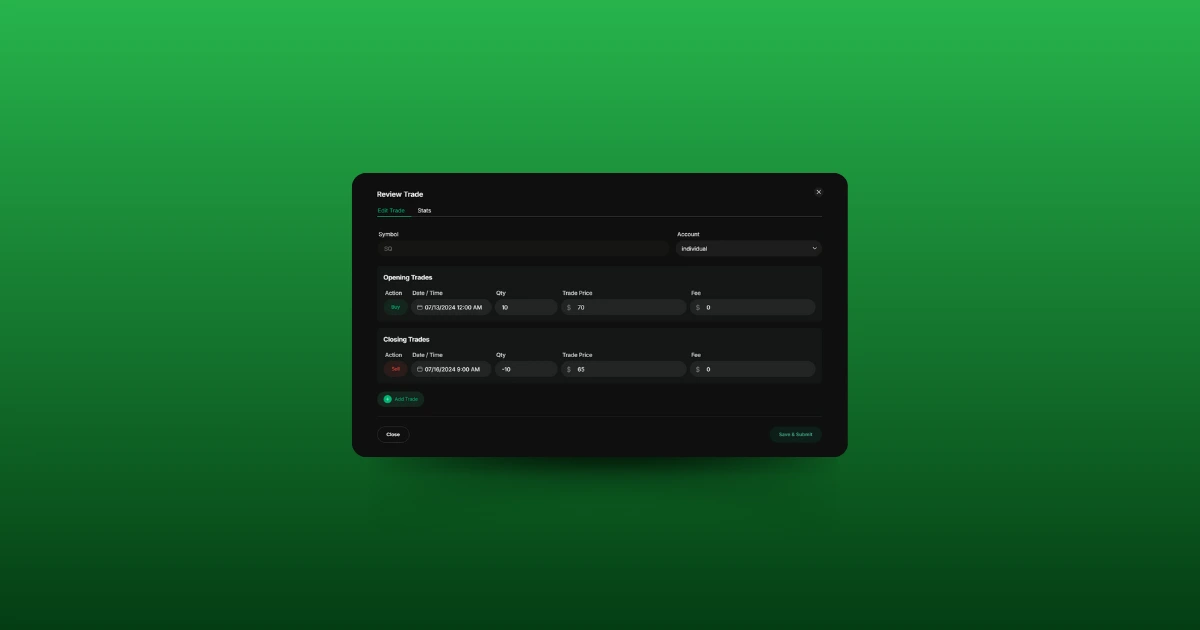

Find the specific trade in the journal table. You can use filters or sorting options to quickly locate the trade you wish to modify. Once found, click the Edit icon on the right-hand side of the trade row. - Open the Edit Trade Window

Clicking the Edit button opens a new window with all the details related to the selected trade. This includes inputs such as:- Action (Buy or Sell)

- Date and Time of the order

- Quantity of shares or contracts

- Trade Price

- Fee

- Account in which the trade was executed

- Modifying Trade Information

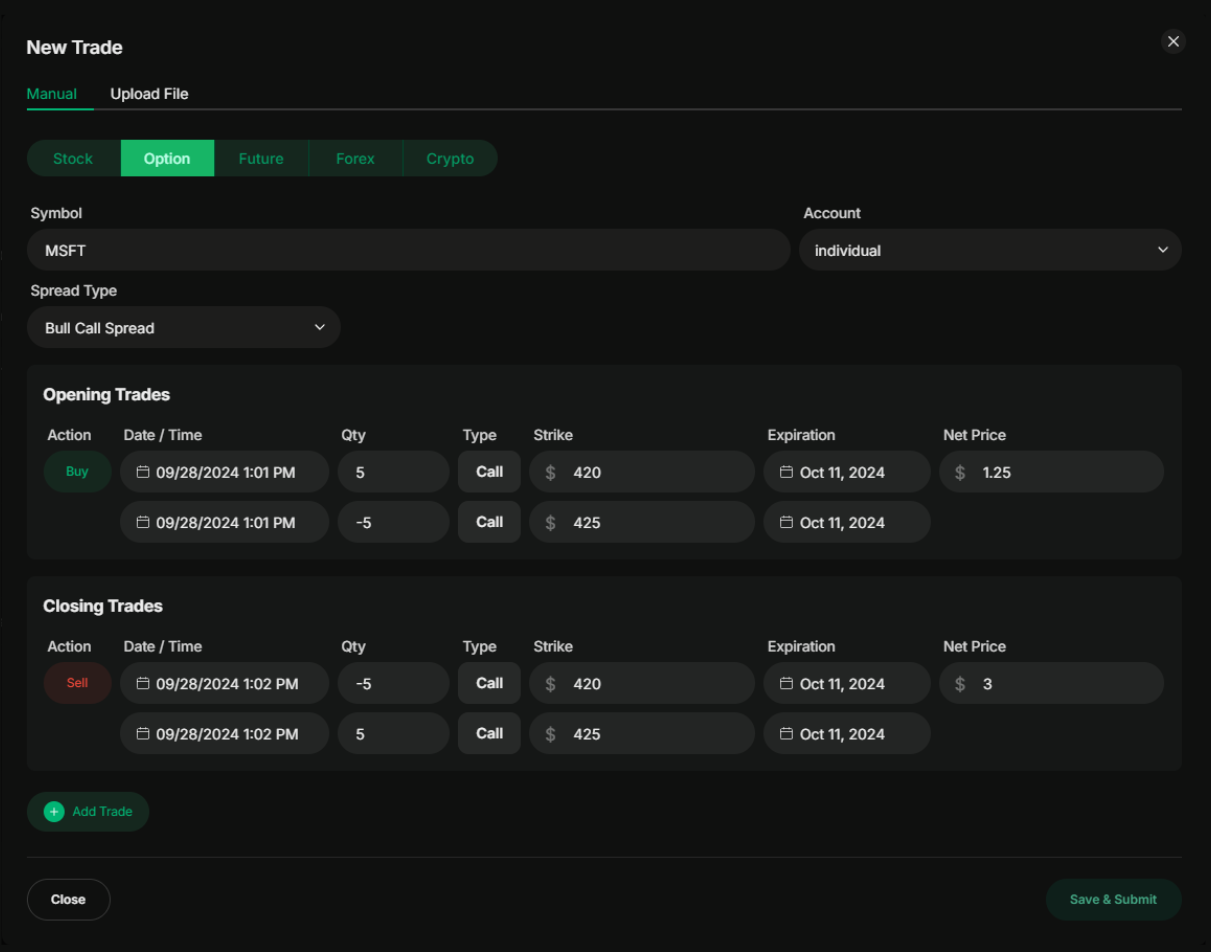

In the edit window, you can adjust any of the fields mentioned above. For example, if you need to change the trade price or correct the date, simply update the information in the corresponding field. - Editing Option and Future Option Trades

If the trade is an options or future options trade, additional fields will be available for editing. These include:- Strike Price

- Expiration Date

- Option Type (Call or Put)

- Updating the Trade

After you’ve made the necessary changes, click Save & Submit to update the trade in your journal. The changes will immediately be reflected in the journal, and your trade metrics will be recalculated accordingly.

What You Can Edit

In the Edit Trade window, you’ll have access to all the key details of the trade. Whether it’s a stock, option, future, or other asset, the editing interface gives you the flexibility to modify the most critical parameters of your trade. Here’s a breakdown of what you can change:

- Action: You can switch between “Buy” or “Sell” depending on how the trade was executed.

- Date and Time: Adjust the exact date and time the trade was placed, down to the minute.

- Quantity (QTY): Modify the number of shares, contracts, or units traded.

- Trade Price: Update the price at which the asset was bought or sold.

- Fee: Change or add the trading fee associated with the trade.

- Account: If you have multiple trading accounts, you can select or update which account the trade was placed in.

If your trade involved options or futures, you’ll see additional inputs specific to these types of trades:

- Strike Price: The strike price is the predetermined price at which the buyer of an option can buy (for a call) or sell (for a put) the underlying asset before or at expiration.

- Expiration Date: The expiration date is the last day on which an options contract is valid, after which the option either expires worthless or is exercised.

- Option Type: Option type refers to whether an option is a Call (giving the buyer the right to buy the underlying asset) or a Put (giving the buyer the right to sell the underlying asset).

Tracking Changes in Your Trading Journal

After making your edits, all adjustments are automatically reflected in your overall trading performance metrics. This means that if you correct a trade’s price, quantity, or fees, the Total P/L, Win Rate, Profit Factor, and other performance metrics will update to reflect the new information. This ensures that your analysis always stays accurate, even if you need to make changes after the fact.