As an options trader, you know that flexibility can be the key to maximizing returns and managing risk. Closing an entire spread in one trade is standard practice, but there are times when it makes sense to “leg out” — that is, close individual legs of your spread separately.

Now, with TraderLog’s latest feature, you can log these partial exits with ease. Whether you’re looking to lock in profits, reduce risk, or adjust your strategy, this new functionality ensures your trading journal reflects every step of your process.

Let’s take a closer look at how it works and why it’s a valuable addition to your trading toolkit.

Why Would You Leg Out of a Spread?

Legging out offers options traders greater flexibility in managing their positions. Here are a few scenarios where this approach might make sense:

- Market Conditions: If the market moves in your favor on one leg, you can close it to lock in profits while keeping the other leg open for potential gains.

- Risk Reduction: Closing a specific leg can help lower your exposure to market movements.

- Incremental Adjustments: Adjust your position without needing to fully exit, giving you more control over your trades.

For example, consider a bull put spread where you sell a 150 put and buy a 140 put for a net credit of $3. Later, when the short put begins to decay, you may choose to close the the 150 put to lock in profits, while keeping the long 140 put expecting the price to drop in the future.

How to Use TraderLog’s Leg Out Feature

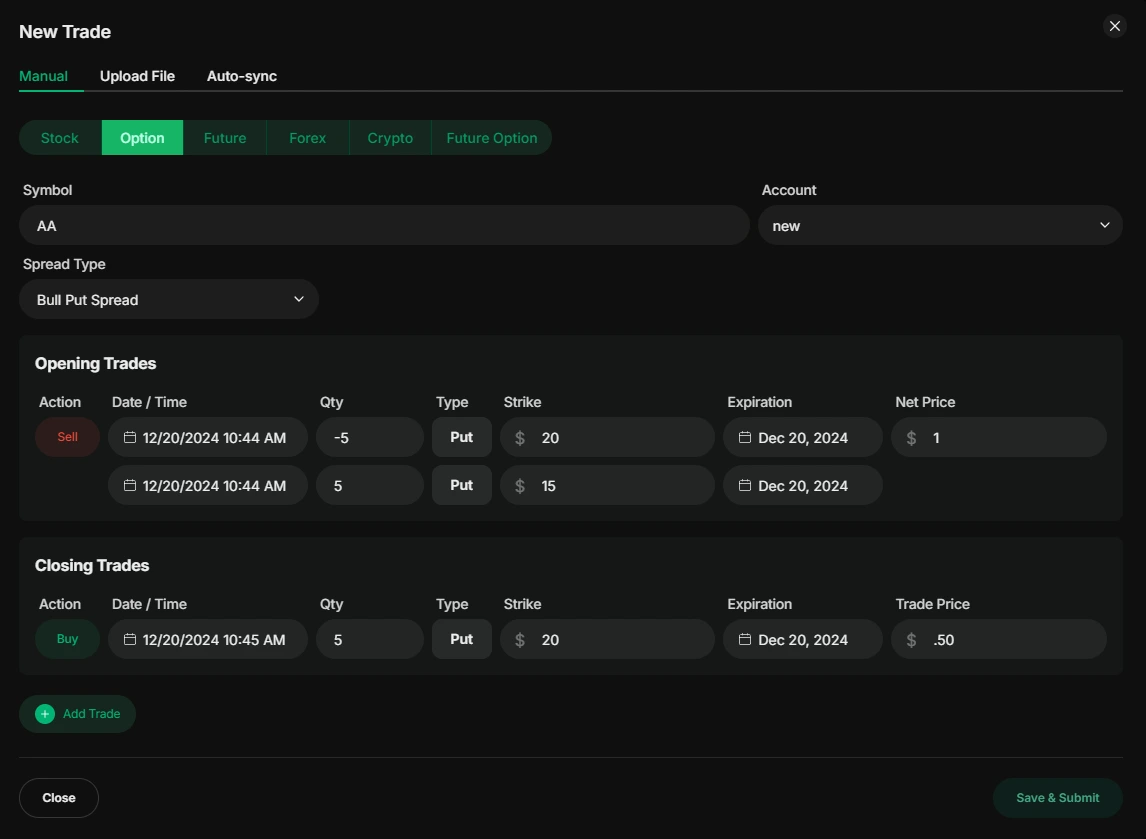

With TraderLog’s user-friendly interface, legging out is straightforward:

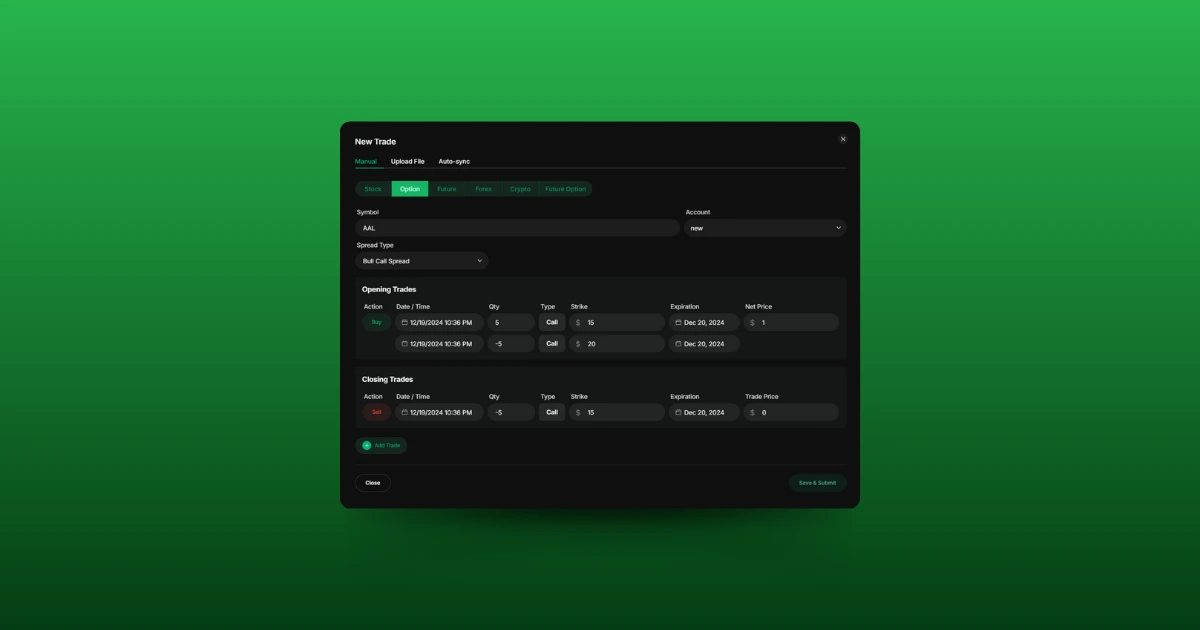

- Open the Trade Entry Window

Start by clicking the Add Trade button to bring up the trade entry screen.

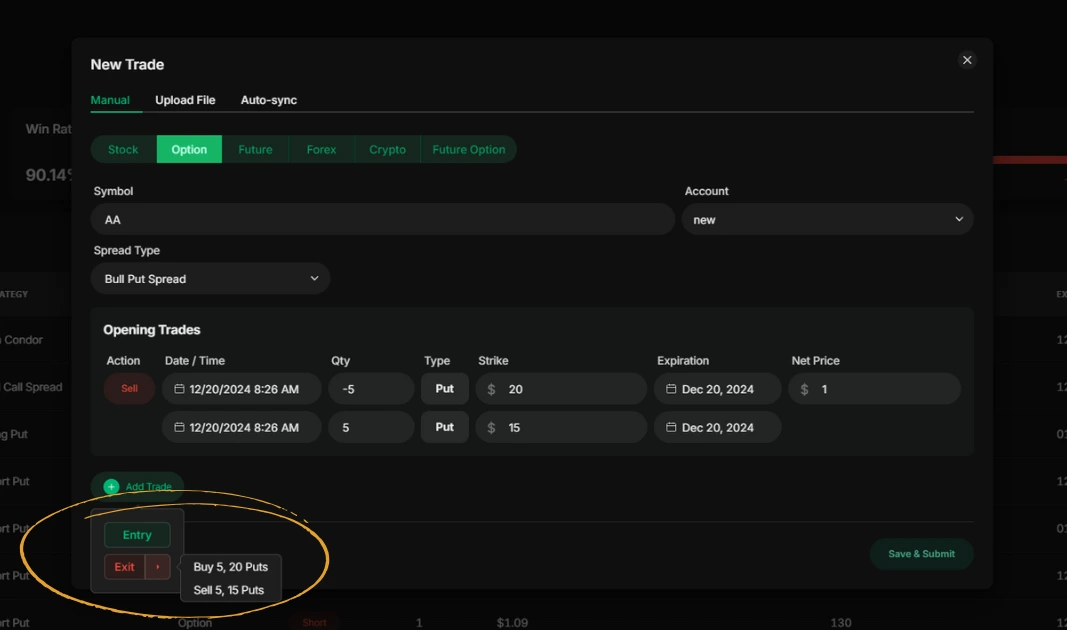

- Access the Exit Options

At the bottom of the trade entry window, you’ll see an Exit button. Click the small arrow on the right to open a dropdown menu displaying the individual legs of your spread.

- Select a Leg to Close

Choose the specific leg you’d like to close. This creates an exit trade for that leg while leaving the rest of the position open.

- Save Your Changes

Review the trade details and save. Your journal will now reflect the updated position, keeping your records accurate and complete.

Practical Examples

Here are a couple of scenarios where legging out might enhance your trading flexibility:

Example 1: Bull Call Spread

- Initial Position: Buy a 150 call and sell a 155 call for a $2 debit.

- Action: Close the 155 call as the stock price nears $155.

- Outcome: The 150 call remains open to capture potential further upside.

Example 2: Iron Condor

- Initial Position: Sell a 145 put, buy a 140 put, sell a 155 call, and buy a 160 call for a $1 credit.

- Action: Close the 155 call as the stock approaches $145. At this point, the stock has fallen, causing the 155 call to decrease substantially in price.

- Outcome: You reduce your upside risk while capturing the profit from the call side of the spread. You now have a long call and short put spread, creating a bullish position.

Why Use TraderLog for Legging Out?

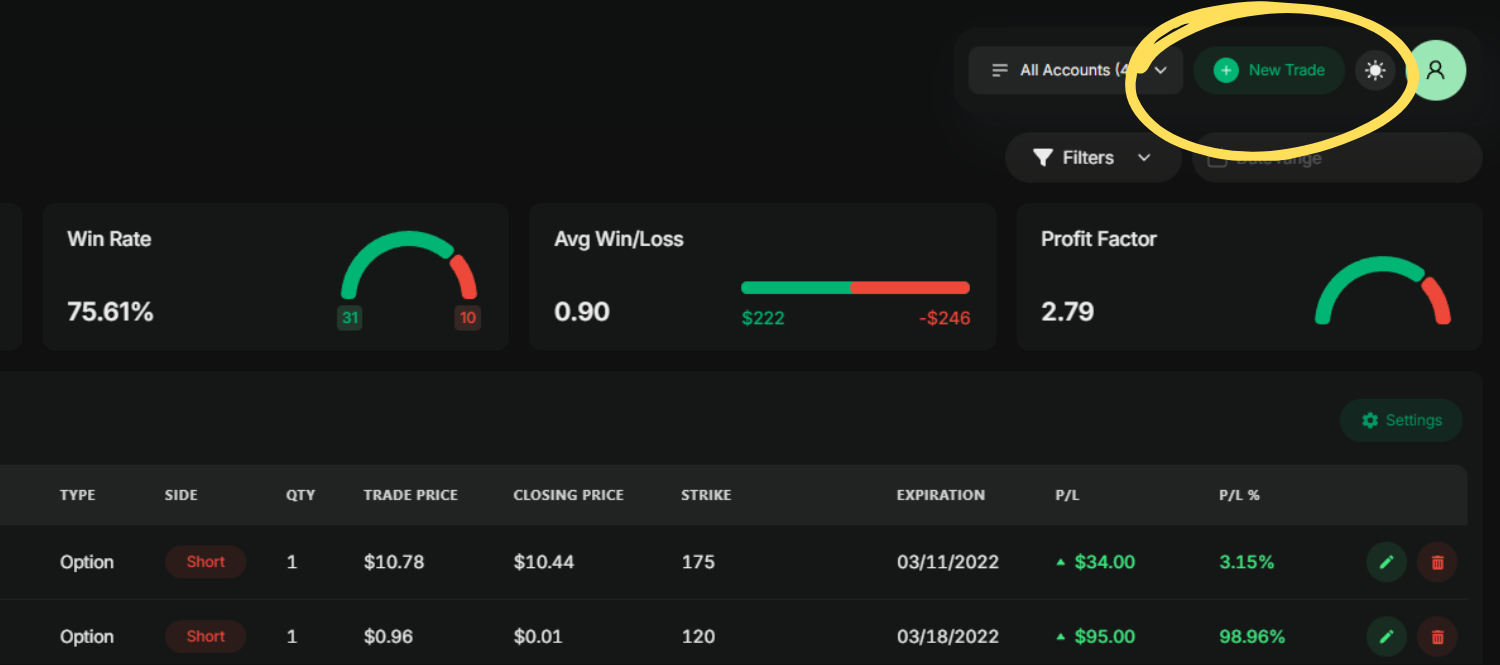

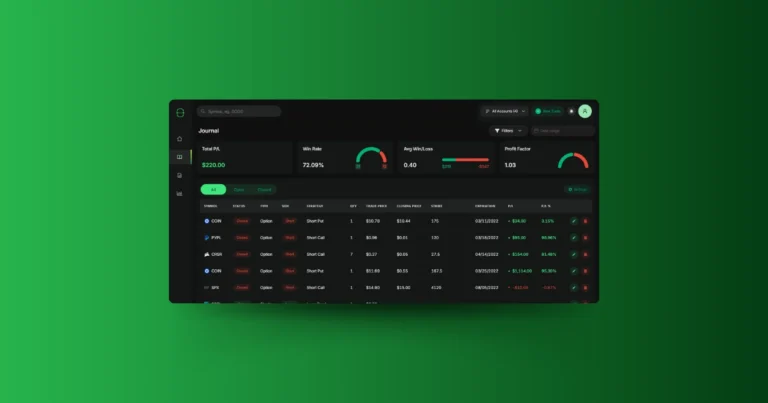

TraderLog ensures you maintain precision and clarity in your trade records. With the leg-out feature, you’ll enjoy:

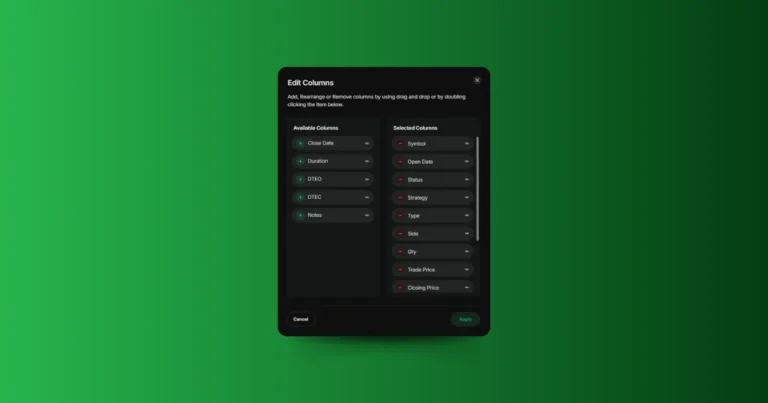

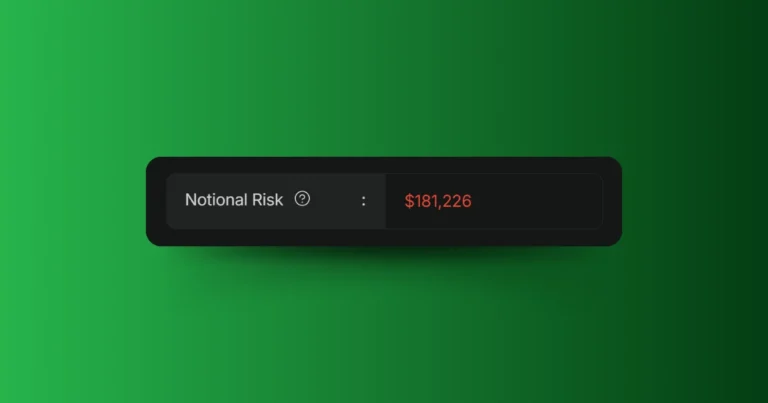

- Accurate Tracking: Capture every partial exit and adjustment for a complete view of your trading activity.

- Enhanced Insights: Analyze the performance of individual legs to refine your strategies.

- Seamless Adjustments: Make updates without sacrificing the quality or accuracy of your journal.

Ready to Elevate Your Trade Tracking?

The new leg-out feature is live and ready for you to use. Whether you’re locking in gains, adjusting risk, or adapting to market conditions, TraderLog has you covered.

If you’re new to TraderLog, start your free trial today and experience the most intuitive trading journal designed for options traders like you.