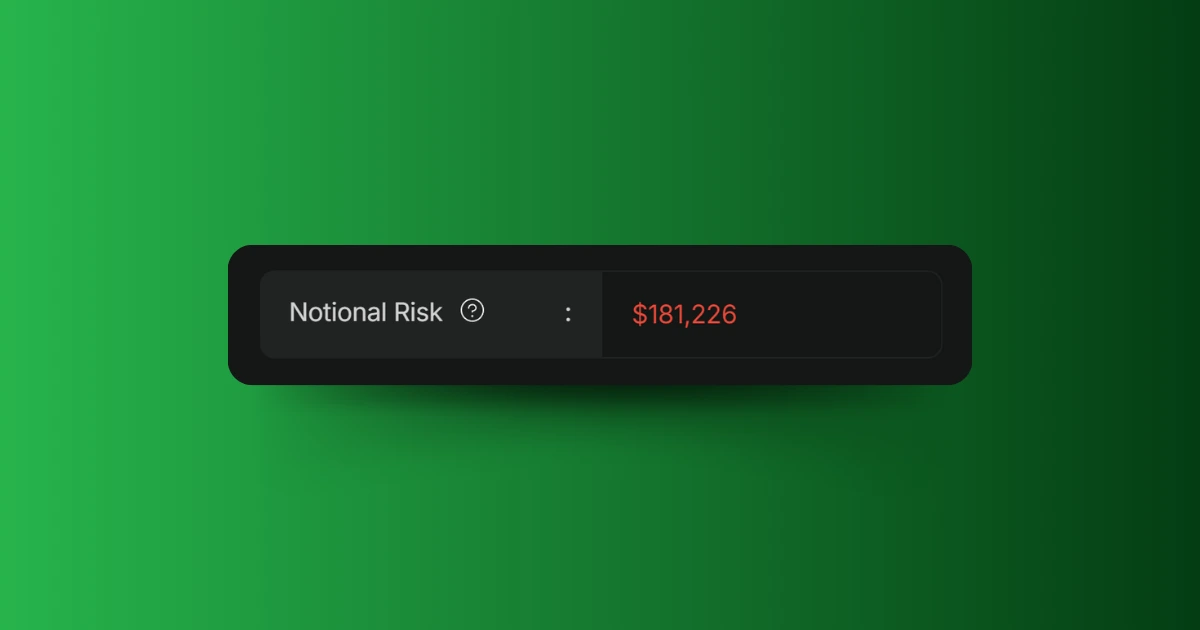

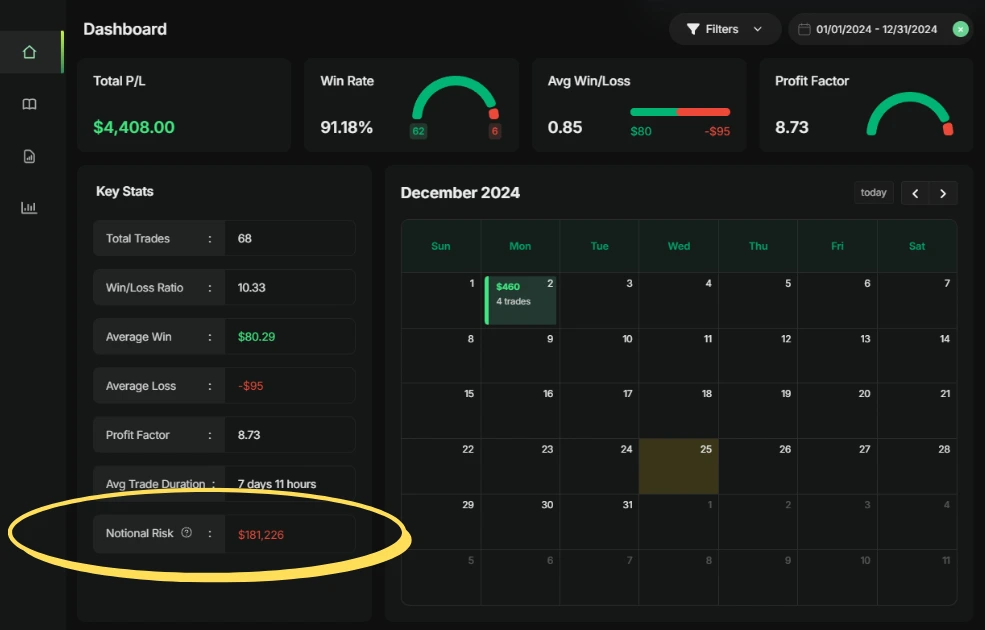

Managing risk is a cornerstone of successful trading, particularly when it comes to short options strategies. To enhance your ability to monitor and assess risk, we’ve introduced the Notional Risk metric to the Key Stats section of your dashboard. This new feature provides a clear, concise measure of the maximum potential dollar risk associated with your short options positions.

Here, we’ll walk you through how notional risk is calculated, the trades it applies to, and how you can use it to make more informed trading decisions.

What Is Notional Risk?

Notional risk represents the maximum dollar risk on your short options positions if the market moves against you. It’s designed to give you a quick understanding of your risk exposure and how it aligns with your overall portfolio strategy.

For example, if you sell a put option, the notional risk considers the strike price of the option, subtracts the premium you received, and multiplies the result by the contract size. Similarly, for multi-leg strategies such as spreads or iron condors, the calculation accounts for the width of the spread and any premiums collected, dynamically adjusting if a trade is partially closed or restructured.

How Is Notional Risk Calculated?

The calculation varies depending on the type of short options strategy:

Single-Leg Options

The notional risk for a single short put is:

Risk = (Strike Price − Premium Received) × Contract Size (100)

Example: Selling one put with a strike price of $50 and receiving $2 in premium results in a notional risk of (50 − 2) × 100 = $4,800

Vertical Spreads

For vertical spreads, the calculation is:

Risk = (Spread Width − Net Premium Received) × Contract Size

Example: Selling a 200 put and buying a 190 put for a total premium of $3 results in a notional risk of: (200 − 190 − 3) × 100 = $700

Multi-Leg Strategies

For multi-leg trades like iron condors or iron butterflies, the calculation uses the width of the widest spread:

Risk = (Max Spread Width − Net Premium Received) × Contract Size

Example: Selling the 100 call, buying the 105 call, selling the 90 put, and buying the 85 put for a $3 net premium results in: (105 − 100 − 3) × 100 = 200

Why Are Short Calls Excluded?

You might notice that short calls aren’t included in the calculation. That’s because their risk is undefined—there’s no upper limit to how high a stock can go. Since the goal of this metric is to give you a clear and precise view of risk, we’ve focused on trades where the potential loss is quantifiable.

How Can This Feature Help You?

Managing risk is one of the most critical parts of trading, especially when you’re dealing with short options strategies. Notional risk gives you a dollar-based view of your exposure, so you can:

- Assess Overall Risk: Quickly understand the dollar amount of potential risk across your short options positions.

- Monitor Position Changes: The metric dynamically updates as trades are opened, closed, or adjusted, giving you a real-time view of your risk exposure.

- Align Risk with Strategy: Use the metric to ensure your trades align with your risk tolerance and portfolio goals.

- Identify High-Risk Positions: Spot trades that may require hedging or adjustments to reduce exposure.

By integrating notional risk into your workflow, you can make more informed decisions and maintain greater control over your portfolio.

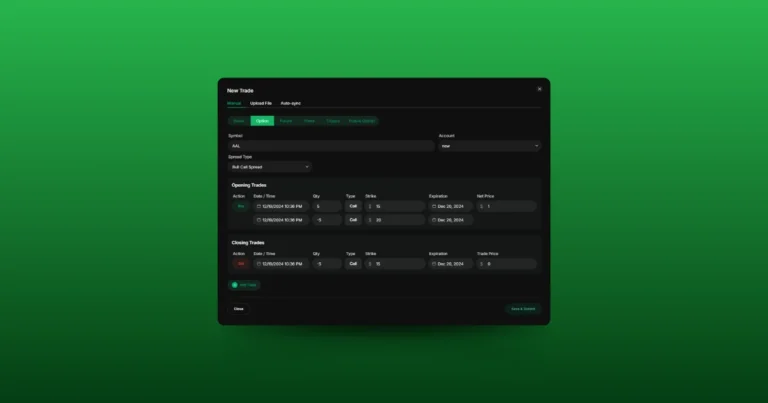

Trades Included in the Calculation

The notional risk metric is calculated for the following strategies:

- Short puts

- Bull put spreads

- Bear call spreads

- Iron condors

- Iron butterflies

- Short straddles (short put leg only)

- Short strangles (short put leg only)

These strategies were specifically chosen because their risks can be precisely defined and calculated.

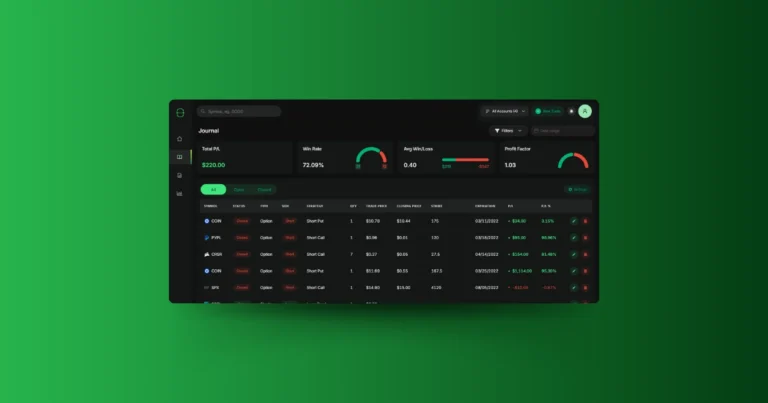

Start Monitoring Your Notional Risk Today

Log in to your dashboard now to explore this new metric in the Key Stats section. With notional risk, you’ll have a clear, actionable view of your short options exposure, empowering you to make smarter, more confident trading decisions.

If you’re not already using our platform, sign up today to take advantage of this and many other tools designed for traders like you.