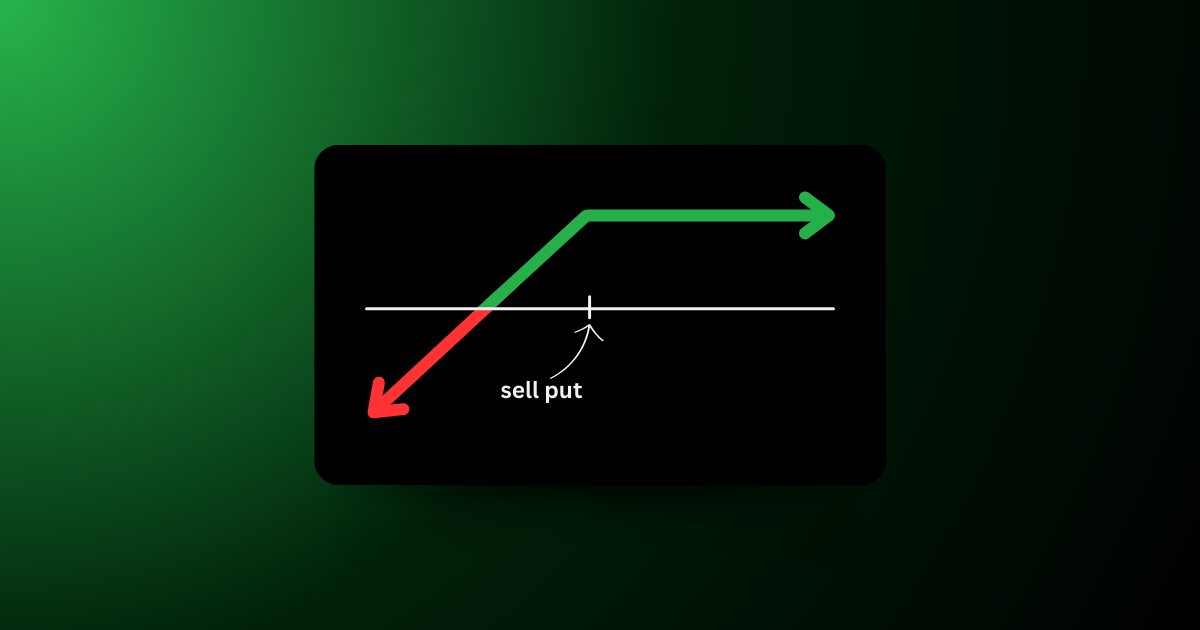

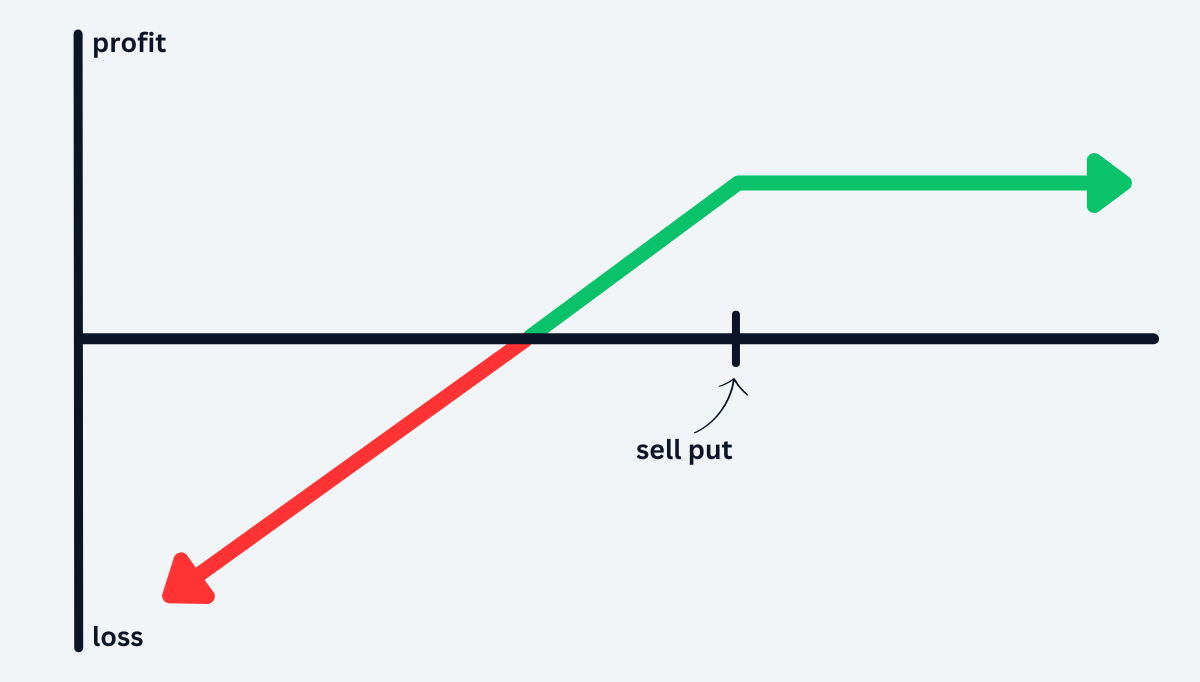

A synthetic covered call is an options strategy aimed to mimic the benefits of a traditional covered call, but without actually owning the underlying stock. It’s created by selling a put option, which generates income and can also be called a naked put.

Just like a covered call, all risk is to the downside. If the stock were to fall in price, you as the seller may be obligated to buy the stock if its price were to fall below the options strike price.

What Is a Covered Call?

Covered calls may be one of the simplest strategies for new options traders. Essentially, defining a price at which you would feel comfortable selling your stock at in order to generate additional income.

The first and main component is to own the stock itself. Since each option contract represents 100 shares of stock, you’ll want 100 shares for each call you intend to sell.

After you’ve purchased the stock, you’d then sell (or write) a call option against that stock. When you sell the call, you’d need to pick a strike price. This being the price you’d feel comfortable selling your stock at in the event it were to rise to that price.

In exchange for selling this options and locking in your shares at particular price, you’d receive a premium — which is essentially the price of the option. This premium is a form of additional income, which is the main purpose behind selling covered calls.

Synthetic Covered Call

A synthetic covered call mimics the profile of a traditional covered call, but without actually owning the underlying stock. It’s created by selling a put, which is essentially a promise to buy the stock later if its price drops below a certain level.

When you sell this put, you get paid upfront. This payment is called a premium and is the max profit potential on the trade. Even though this might seem safer than some other options strategies, there’s still a risk. If the stock’s price falls too much, you’ll have to buy it at the price you promised.

Here’s how it’s done:

- Sell a Put Option: A trader sells a put option on a specific stock, hoping it won’t fall below the strike price. If it does, they’ll be obligated to purchase the stock at that strike price.

Potential Risks and Rewards

A synthetic covered call has both defined risk and reward. The primary goal is to generate income from time decay while maintaining a neutral to bullish outlook on the underlying stock.

The risk lies entirely to the downside. If the stock price falls below your strike price, you’d be forced to buy the stock for a higher price than it’s currently trading for today. The risk would then be like holding any other stock. If the stock continues to fall, you continue to lose money on the shares you now hold.

- Maximum Profit: This is limited to the premium received from selling the put. Full profit is realized if the stock remains above the put option’s strike price through expiration.

- Maximum Loss: The maximum loss in a synthetic covered call only occurs if the stock falls to $0. This can be calculated by finding the breakeven point and multiplying it by 100 shares.

- Breakeven: This is found by subtracting the premium received from the option’s strike price. If the stock price is greater than the breakeven at expiration, you’ll make a profit. If it’s below this price, you’ll realize a loss.

Real-Life Examples

To see the actual strategy in practice, let’s go through a couple of real-life examples and their possible outcomes:

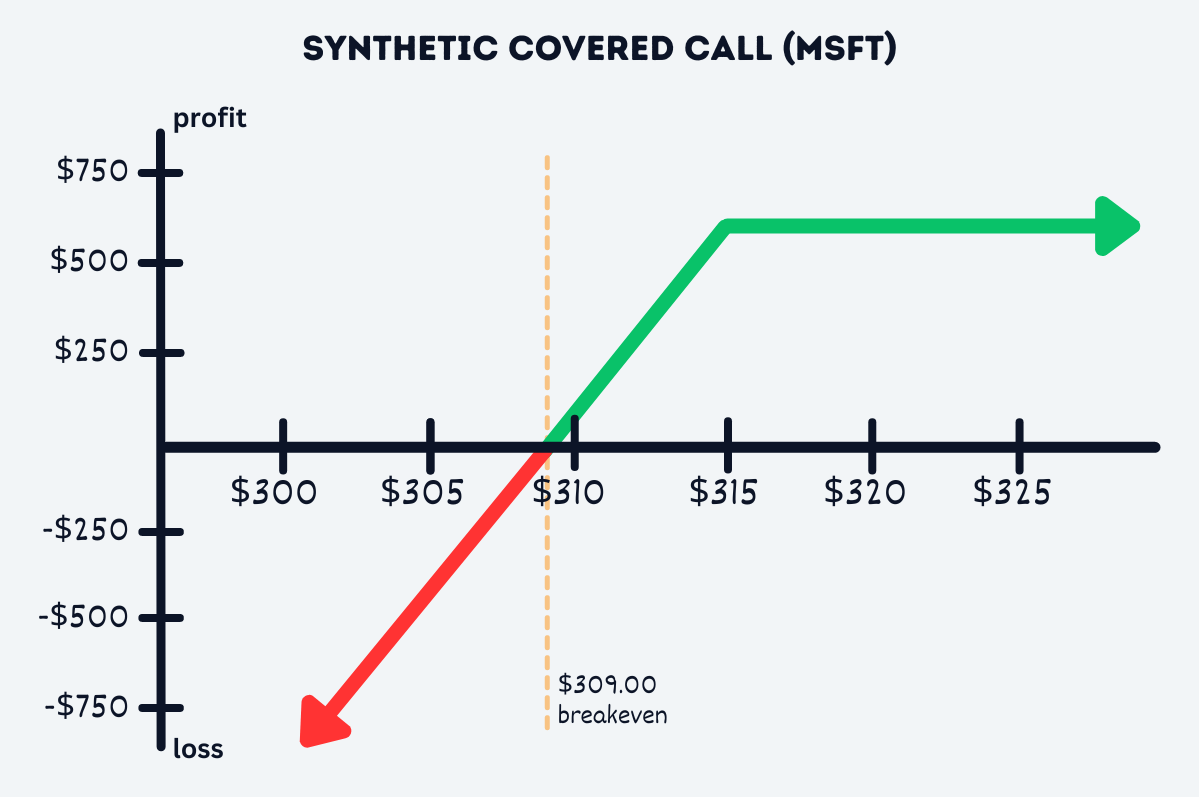

Example 1: Synthetic Covered Call on Microsoft

For this first example, let’s look at Microsoft which is currently trading at $320. Let’s assume you have a neutral, but slightly bullish outlook on the stock. Because of that, you decide to trade the following synthetic covered call:

- Selling the Put Option: You choose to sell a put option with a strike price of $315. In return, you receive a premium of $6 per option, which translates to a credit of $600 for the contract (100 shares).

Based on the credit received and the strike price chosen, we can calculate the following values:

- Max Profit ($600): This is the premium received from selling the put, realized if the stock price remains above the strike price of $315 at expiration.

- Max Loss ($30,900): This would only occur if the stock value falls to $0. Calculated by taking the strike price of $315 minus the $6 premium, multiplied by 100 shares.

- Breakeven ($309): This is found by subtracting the premium ($6) from the strike price ($315). If the stock is at this price at expiration, you neither make nor lose money on the trade.

Let’s take a look at a few potential outcomes:

- Outcome A (Minor Bullish Move): Microsoft’s stock price rises to $325 by expiration. The put option expires worthless since it’s out-of-the-money. You retain the entire premium, resulting in a profit of $600.

- Outcome B (Mild Bearish Move): Microsoft’s stock drops to $310 and the put option is in-the-money by $5. Factoring in the $6 premium you initially received, your net profit is $1 per share — or $100 in total.

- Outcome C (Large Bearish Move): If Microsoft were to drop to $290, the put option is in-the-money by $25. After deducting the $6 premium you initially received, your net loss is $19 per share — or $1,900 in total.

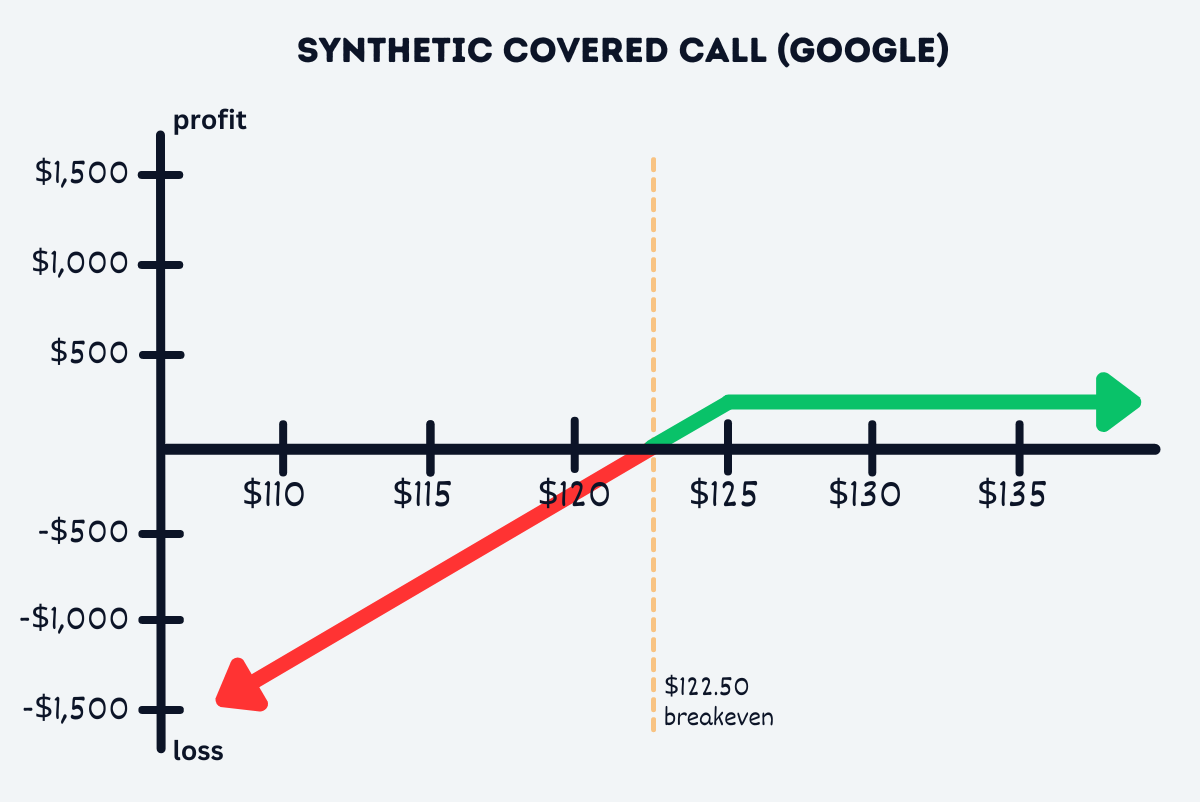

Example 2: Synthetic Covered Call on Google

For our second example, let’s take a look at Google which is currently trading at $130. Since you have a slightly bullish stance on Google, you decide to trade the following synthetic covered call:

- Selling the Put Option: You sell a put option with a strike price of $125, collecting a premium of $2.50 per contract. This results in a credit of $250.

Using the credit received and the strike price, we calculate the following values:

- Max Profit ($250): This equals the premium received from selling the put option. This occurs if the stock price remains above the strike price of $125 at expiration.

- Max Loss ($12,250): This only happens if the stock price plummets to $0. It’s calculated by subtracting the premium from the options strike price, and then multiplying by 100 shares.

- Breakeven ($122.50): Calculated by taking the premium received ($2.50) from the strike price ($125). The stock should be at this price at expiration for the trade to break even.

Here’s a few potential scenarios:

- Outcome A (Slight Bullish Move): Google’s stock rises to $132 by expiration. The put expires worthless since it’s out-of-the-money, allowing you to keep the entire premium, resulting in a profit of $250.

- Outcome B (Bearish Move): Google’s stock price drops to $120. The put option is in-the-money by $5. After considering the $2.50 premium you received, your net loss is $2.50 per share or $250 in total.